Russia's monetary separation and the cryptographic money gifts filling Ukraine have increased the focus on states' crypto drives and the possible job of computerized resources.

An expansionist China, seemingly a considerably more noteworthy challenger than Russia to the U.S-drove rules-based request, "will before long endorse a third cluster of territories set to send off preliminaries of its advanced yuan money," as indicated by Reuters, which refered to state-upheld monetary outlet Securities Times. The report says that "various urban communities and areas have applied to experts for authorization to test the advanced yuan," including the urban communities of Guangzhou, Chongqing, Fuzhou and Xiamen.

In the mean time, as per a report in the South China Morning Post, experts said that "Western authorizations forced on Russia following the attack of Ukraine, including avoidance from the SWIFT monetary informing framework, could offer new advancement open doors for China's computerized money and its local yuan cross-line installment framework."

One examiner stated, "It is essential and pressing to enthusiastically advance yuan internationalization, particularly the improvement of the CIPS framework (Cross-Border Interbank Payment System set up to support worldwide utilization of China's cash in exchange repayments) and the computerized yuan."

China's crypto account, however, has all the earmarks of being centered around its national bank computerized money, or e-yuan. A note by the Financial Stability Bureau of the Chinese national bank uncovered that China's portion in bitcoin exchanges has declined 80 rate focuses after the public authority's crackdown.

"The worldwide portion of Bitcoin exchanges in China has dropped quickly from over 90% to 10%," the note said.

China's crypto account seems, by all accounts, to be speeding up again similarly as Ukraine produced an undeniable degree of crypto reception fervor by reporting an airdrop for gifts, a first by a country. It must be dropped after it became evident that an outsider might have been mocking the eagerly awaited occasion.

All things considered, Ukraine will report NFTs (non-fungible tokens) to help Ukrainian Armed Forces soon, as indicated by Mykhailo Fedorov, Ukraine's clergyman of computerized change.

***

India, the world's biggest majority rule government, may make its assessment strategy more clear by tweaking the meaning of crypto or virtual advanced resources. As indicated by a report by CNBC TV-18, the Indian government is probably going to change the definition to explain that main cryptographic forms of money, crypto tokens, NFTs and vouchers fall under the meaning of virtual computerized resources, yet not different classes, for example, Demat shares, Visa focuses, successive flier focuses, e-vouchers, cash bank focuses, and so on The public authority will likewise incorporate a nitty gritty FAQ to clarify the definition, as per the report.

***

And keeping in mind that the world has its eyes on the U.S. Central bank and its arrangements to battle expansion, the discussion around what expansion will mean for digital currencies stays dynamic.

Adding to the discussion, Bill Gross, the "bond lord" who helped to establish the Pacific Investment Management Co. (PIMCO), said he sees the chance of stagflation and he wouldn't buy stocks forcefully now, as per CNBC.

Nonetheless, Kathy Bostjancic, boss U.S. financial expert at Oxford Economics, told CNBC "we are not in stagflation yet."

Stagflation happens when stale monetary development, high joblessness and high expansion happen simultaneously.

Technician's take

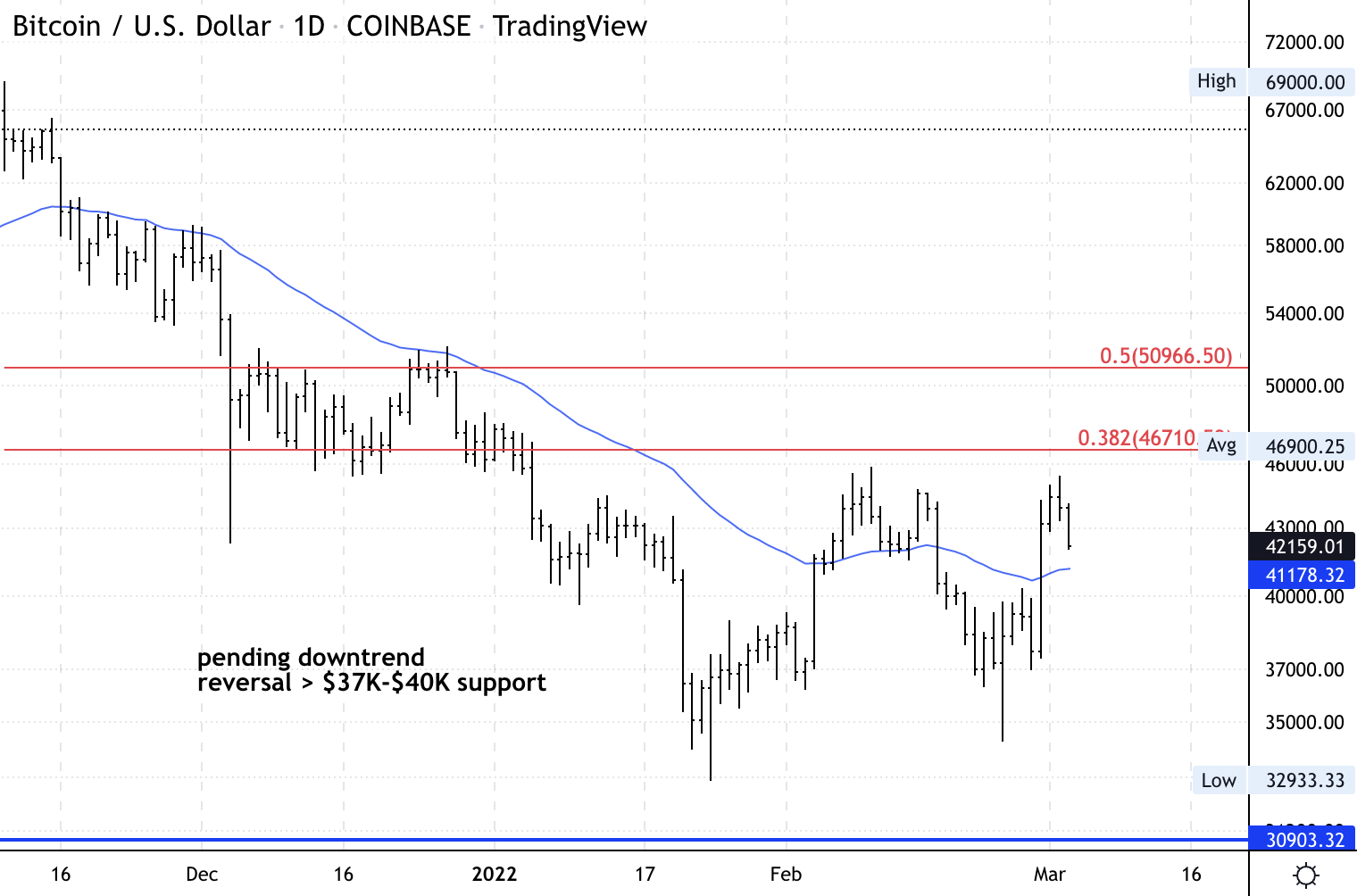

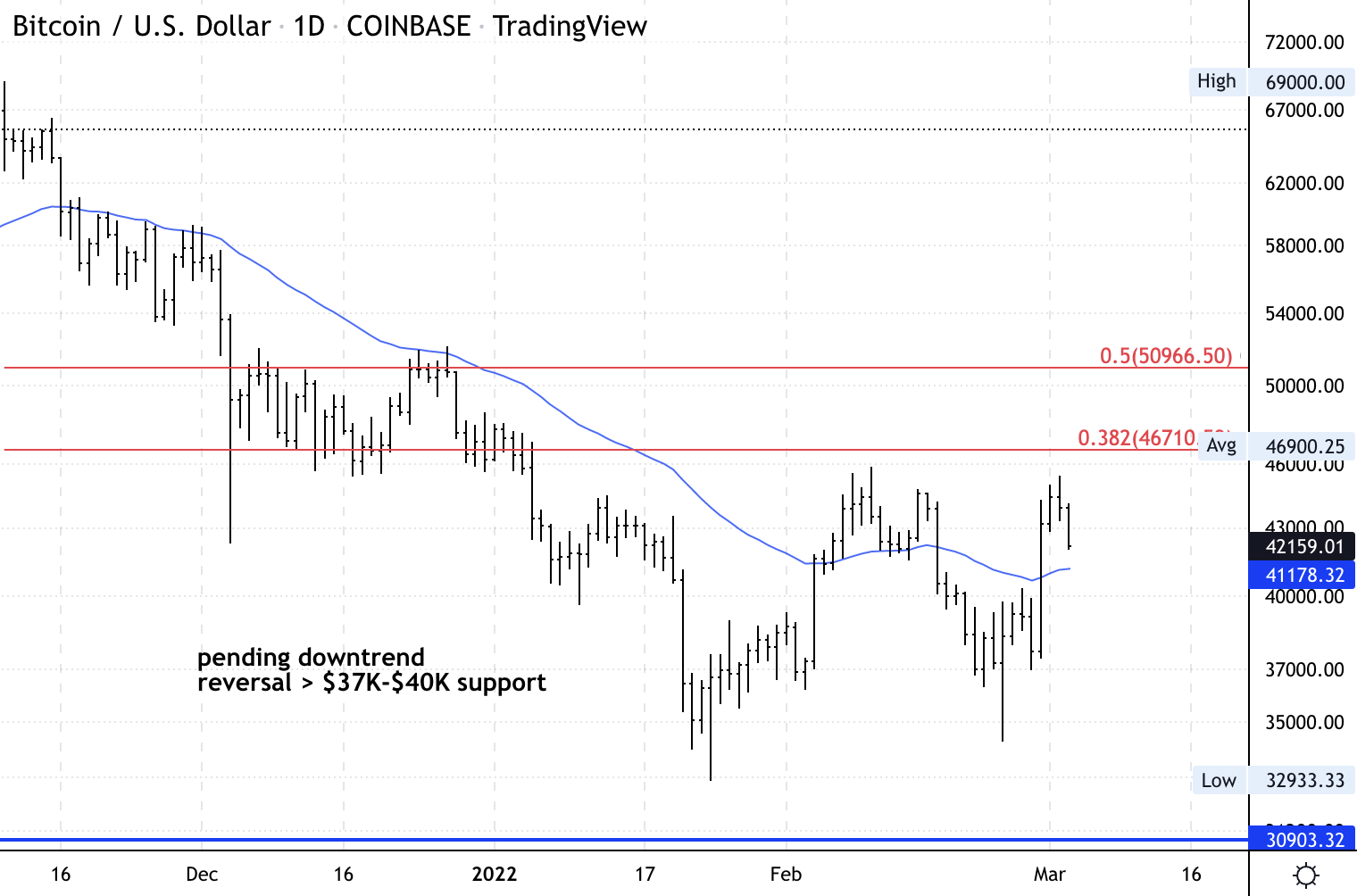

On Thursday, bitcoin expanded its pullback from the $45,000 opposition level, albeit beginning help at $40,000 could settle the down move.

Purchasers should keep BTC over the $37,000 breakout level to support the recuperation stage. Further, assuming that force fabricates, a definitive move above $46,000 could yield further potential gain focuses toward $50,000.

Intraday outlines are giving beginning indications of disadvantage weariness, which could empower transient getting tied up with the Asian exchanging day.

Important events

6 p.m. HKT/SGT (10 a.m. UTC): Europe retail sales (Jan. MoM/YoY)

9:30 p.m. HKT/SGT (1:30 UTC): U.S. labor force participation rate (Feb.)

9:30 p.m. HKT/SGT (1:30 UTC): U.S. average hourly earnings (Feb. MoM/YoY)

CoinDesk TV

Chainalysis on Russia-Ukraine War: What Do Blockchain Data Reveal About Sanctions Compliance or Evasion, Ukraine Cancels Crypto Airdrop Ahead of Scheduled Snapshot

Turning around plans, Fedorov, the Ukrainian advanced serve, reported the abrogation of an airdrop to crypto benefactors by means of his Twitter account. "First Mover" has talked with Salman Banaei of Chainalysis for experiences into following crypto exchanges during the Russia-Ukraine war and how to guarantee crypto isn't utilized for to sidestep sanctions. Specialized expert Timothy Brackett of The Market's Compass, gave his crypto market examination.

Headlines

US Tax Agency Moves to Dismiss Lawsuit by Tezos Stakers Who Refused Refund, Demanded Trial: The Internal Revenue Service argues that Joshua and Jessica Jarrett had no right to refuse the refund of almost $4,000, which was paid, therefore the case should be dropped.

Longer reads

Other voices: Analysis: Crypto exchanges won't bar Russians, raising fears of sanctions backdoor (Reuters)

Said and heard

"Russia's reliance on frameworks like SWIFT bank informing, reporter banking and ApplePay is a result of the worldwide predominance of a bound together market-entrepreneur business as usual. This the norm addresses the neoliberal "Finish of History" that was generally ventured to have shown up with the fall of the Soviet Union. However, there might be no more excellent indication of the finish of the End of History than the weaponization of money happening at present." (CoinDesk feature writer David Z. Morris) ... "I'm composing this allure from a fortification in the capital, with President Volodymyr Zelensky close by. For seven days, Russian bombs have fallen upward. Notwithstanding the consistent torrent of Russian fire, we stand firm and joined in our purpose to overcome the intruders." (Andriy Yermak, top of the Presidential Office of Ukraine, for The New York Times) ... Halting significant banks like Sberbank from utilizing dollars barring others from the Swift informing framework actually dives the economy into mayhem, particularly assuming that unfamiliar organizations are hesitant to purchase Russian energy notwithstanding the area's express prohibition from sanctions. However, hard cash will presumably continue to spout in through energy-centered banks like Gazprombank, and can hypothetically be utilized to pay for imports and purchase the ruble. (The Wall Street Journal) ... In Beijing, the expanding influences of a move that might cost China beyond all doubt are currently soaking in, say the authorities and consultants. A few authorities say they are unfortunate of the outcomes of getting so near Russia to the detriment of different connections particularly when Russian hostility against Ukraine is segregating Moscow in a large part of the world. (The Wall Street Journal)

Comments

Post a Comment